Elevations digital banking

Online or on your phone

To get started with Elevations Digital Banking, download the Elevations Digital Banking app from Google Play(opens in a new window) or The IOS App Store(opens in a new window) today or click the "Log In" button above, click ‘New to digital banking? Enroll now.’ and follow the prompts. Once you’re signed in, be sure to take the following steps to begin your Elevations Digital Banking experience. - Enroll in our credit score reporting tool, SavvyMoney. - Check your transfers. - Set up alerts. - Set up the budgeting tool. - Give your accounts nicknames.

Digital banking benefits

Bank your way - Do nearly any transaction on your phone or computer.

One app for all - Business and personal members will use the same mobile app.

Personalized money management – Set saving goals, manage budgets, and track your progress.

Credit score monitoring: View and understand your latest credit score and report.

Expanded member support - With enhanced tools like messaging, on-screen collaboration, and convenient inline help content, our goal is to help you every step of the way on this new journey.

Mobile App Benefits

Available for Google and Apple devices.

Elevations Digital Banking mobile app offers 24/7 availability and the same great features as the web browser.

Simple navigation

Easy to use mobile deposit

Real time fraud protection

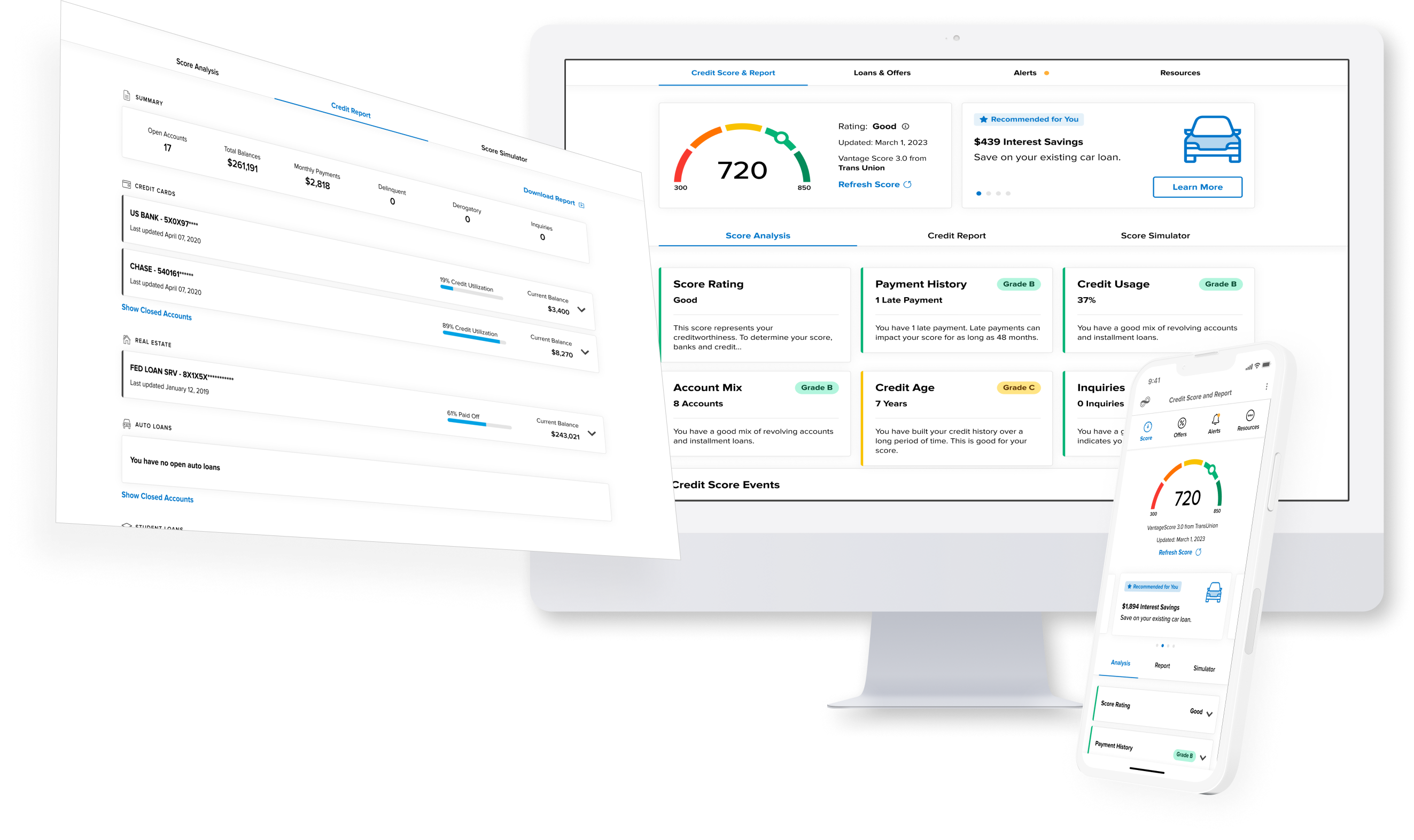

CREDIT SCORE AND MORE

Don't miss a beat with your credit score.

Get to know and learn to improve your credit score. Elevations members can access the credit reporting tool SavvyMoney for free in Digital Banking. Use it to see:

Your credit score, updated as often as each day

Key factors that impact your score

Credit score goals, progress tracking and simulations

Your full credit report, updated weekly

Daily credit monitoring and alerts

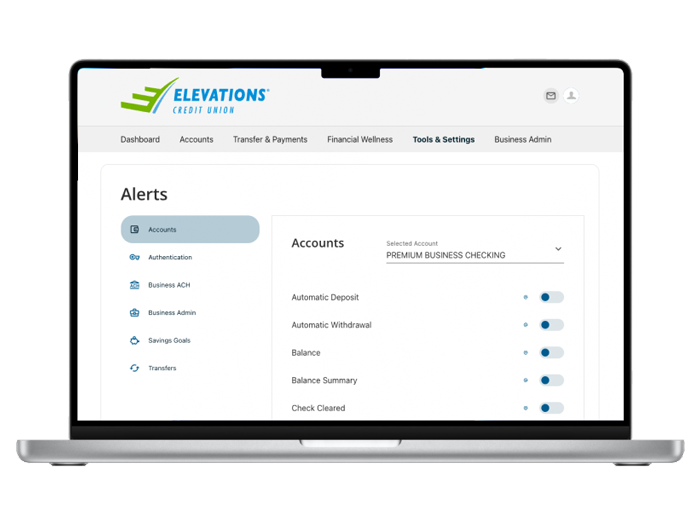

FEATURES TAILORED FOR BUSINESS

Digital Banking for Business

Enjoy features tailored to your business needs including:

Create and manage sub-user access and permissions

Transfer and payment authorization flows

ACH payments and collections

Manage domestic wires and payees

Integrated bill pay with sub-user entitlements

Business specific alerts

QUICKBOOKS® AND ELEVATIONS BUSINESS CREDIT CARDS

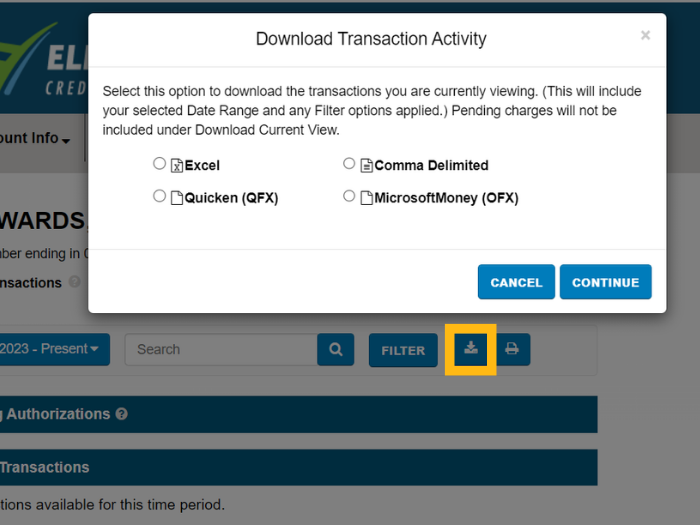

Adding credit card transactions to QuickBooks®

To import your business credit card transactions to QuickBooks®, follow these steps:

Access the Service Center by clicking on the link from your loan in Digital Banking

Click on “Account Information” then “Account Activity.”

Click on the “Download Transactions” icon at the top right corner of the page.

Choose “Comma Delimited” as the file format and select the date range you want to download.

Click on “Download File” and save it to your computer.

On the QuickBooks menu on the left, go to “Transactions,” “Bank Transactions,” and hit enter. This will refresh the page. Cursor to the right “Link Account” box, click on the carrot for the dropdown and select “Upload from file.”

Browse to the file you saved and click “Open.”

Choose the account you want to import the transactions to and click “Continue.”

Review the transactions and click “Add” to register them in QuickBooks.

For questions or additional support, please contact Business Services at [email protected](opens in a new window) or 303-443-4672 X 1620.

Commonly asked Business Banking questions

Yes. You can use both QuickBooks and Quicken. Simply set up a new connection between the tool and your Elevations account.

To view card rewards, business members will need to register on the card rewards site and set up a separate login to access it.

To register for card rewards access:

From digital banking, click Tools & Services > Card Rewards (or visit https://rewards.elevationscu.com(opens in a new window))

In the upper right corner click "Register" and complete the enrollment process

Members can also contact our Card Rewards vendor for assistance at 844-232-8793

Getting Started

A simple step you can take for our new digital banking app

Update your mobile device

To help with a smooth transition to our new mobile banking experience, we encourage you to update your Apple or Android device’s operating system. Follow these steps to ensure you are on the latest operating system for your device: For Apple users: 1. Go to ‘Settings’ 2. Tap ‘General 3. Tap ‘Software Updates’ 4. If a new update is available, you’ll be prompted to install the update For Android users: 1. Open ‘Settings’ 2. Select ‘About Phone’ 3. Tap ‘Check for updates’ 4. If an update is available, you will be prompted to install the update.

Updating your external transfers

How to set up new External Transfers with Elevations Digital Banking?

Follow these steps:

Select “Transfers & Payments.”

Go to “Add Accounts.” You can link external accounts in one of two ways: - Add an account instantly using the sign-in credentials for your other institution. - Add an account manually and verify via microdeposits.

Once your account is verified, you can select it from the “From Account” or “To Account” options in the dropdown menu and set your desired transfer amount and frequency.

How to log in for the first time

Visit our login page and follow these steps for your first time logging in to Elevations new Digital Banking. The whole process will take less than a few minutes to complete.

Enter current credentials

Start by entering your current credentials to access your accounts.

Confirm identity

You will be sent a one time password to confirm your identity

Authenticate

Enter the one time password you received to confirm your identity

New Password

Follow the steps to create your new password

Registration complete!

You’re registered! We hope you enjoy Elevations Digital Banking!

Commonly asked questions

SavvyMoney is entirely free to Elevations members.

Accessing your score through SavvyMoney is a “soft inquiry” which does not affect a credit score. Lenders use “hard inquiries” to make decisions about creditworthiness when you apply for loans.

SavvyMoney makes it a best practice to show the most relevant information from a credit report. If you think some information is wrong or inaccurate, you can get a free report from www.annualcreditreport.com and then dispute inaccuracies with each bureau individually. Each bureau has its own process for correcting inaccurate information, but SavvyMoney users can file a dispute with Transunion by clicking on the “Dispute” link within the tool. Transunion will share this with the other bureaus if the inaccuracy is verified.

Three major credit-reporting bureaus (Equifax, Experian and Transunion) and two scoring models (FICO or VantageScore) determine credit scores. Financial institutions use different bureaus as well as their own scoring models. Over 200 credit report factors may be considered when calculating a score, and each model may weigh credit factors differently. This means no scoring model is identical.

Have questions? We’re here to help.

Your Credit Union Virtual Assistant

Chat with Scout!

Scout makes it easy to find the answers you need. In addition to fulfilling simple requests, Scout can seamlessly reroute your more complex requests to Elevations team members, helping you get in touch with the right person to help serve your needs. (Monday-Friday: 7:00 am-6:00 pm and Saturday: 8:00 am-1:00 pm MT) You can always connect with an Elevations team member in person, via chat, and by phone. Elevations is dedicated to constantly improving your digital banking experience.